FAQs

Who is responsible for providing affordable housing in Florida?

The private sector in Florida provides affordable housing.

In 1991, The Florida Home Builders Association (FHBA) and the Florida Realtors intent on creating jobs in the housing construction industry and getting more low and moderate income families into home ownership, respectively, asked the Florida Legislature to increase the transfer fee on all real property transactions (a fee/tax on their industry) and dedicate that increment to the state and local housing trust funds. These trust funds are referred to as the Sadowski state and local housing trust funds.

Several statutory parameters were “must haves” for these industry groups. These include:

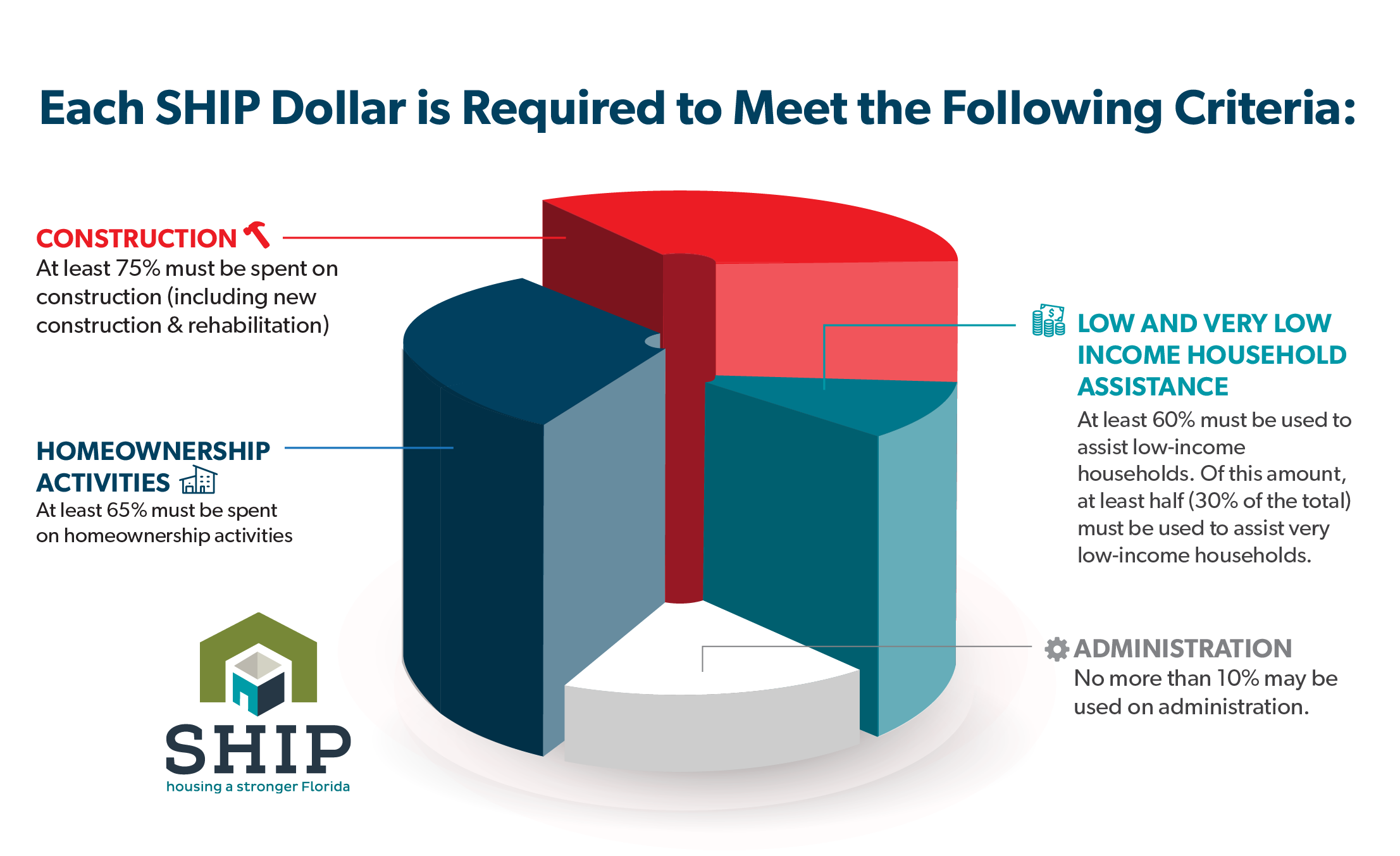

1) That the monies be dedicated solely for affordable housing;

2) That most of the funds (75%) are used for construction related activities (that does not mean new construction- rehabilitation or refurbishing substandard properties meets the construction related requirement); and,

3) That most of the local housing trust funds (65%) are used for home ownership related activities (this also is not restricted to new home ownership- rehabilitation or refurbishing substandard homes meets the home ownership requirement).

If the Housing Trust Fund monies are used in FY 2024-25 for their intended purpose of housing - what would be the impact on Florida's economy?

Over 44,000 jobs – including putting subcontractors to work and over $7.2 billion in positive economic impact and build, rehabilitate or sell over 14,000 housing units

How do I contact my local legislator to discuss the importance of allocating all the Sadowski Trust Funds for affordable housing programs in Florida?

Call your local legislators office (here is a link to help you find your House and Senate members) and ask to meet with the legislator to talk about affordable housing. Please contact the Florida Housing Coalition to let them know when you have an appointment. We can provide you with materials and information that may make your visit more productive. The meetings you have in the district/home offices of the legislators are extraordinarily important. Legislators need to hear from their constituents. Here are some Tips for Meeting with your Legislator.

How much will my local community receive in SHIP funds if the legislature passes the current appropriation into the state and local housing trust fund?

The Budget Bill, which includes the allocation of local and housing trust funds, must first pass the Senate TED (Transportation, Tourism and Economic Development) Appropriations Subcommittee and the House TED (Transportation & Economic Development) Appropriations Subcommittee. It then goes to the full Senate and House Appropriations Committee and ultimately to the Governor for signature.

The Sadowski website will be continually updated during this process to give district breakdowns of the current proposed housing trust fund allocations and the expected local economic impact. These Local Economic Impact snapshots are instrumental in continuing the discussion with local legislators on the need for housing resources in their districts.

How are the Sadowski state and local housing trust funds distributed and are these monies grants or loans for affordable housing?

The Local Government Housing Trust Fund receives about 70% of the total Sadowski housing trust funds appropriated each year for the State Housing Initiatives Partnership (SHIP) program. These monies fund housing programs in all 67 counties and larger cities for rehabilitation/renovation of existing housing stock, first time home ownership with down payment and closing cost assistance, rehabilitation and retrofit. The State Housing Trust Fund receives the remaining 30% of the total Sadowski housing trust funds for Florida Housing Finance Corporation programs such as the State Apartment Incentive Loan (SAIL) program.

In all instances, The SHIP and SAIL program funds are secured with a note, mortgage, and/or deed restriction outlining the affordability period, resident income restrictions and/or the terms of repayment, with the exception in some cases for emergency repairs or retrofits needed for special needs, such as the frail elderly and disabled persons’ homeowner safety.

Are Housing Trust Funds used to put families into home ownership who should have been renters?

Absolutely not.

The SHIP program, used for down payment and closing cost assistance to help families into first time home ownership, has been a staple of almost every local jurisdiction. The families put into first time home ownership with SHIP funds receive home buyer counseling and a 30-year fixed rate mortgage. Many homeowners also receive post- purchase counseling. The foreclosure crisis in Florida has only affected families with SHIP loans if they lost employment; no SHIP home would have been lost due to the terms of the mortgage. Typically, families who were fortunate enough to receive SHIP assistance ended up paying less of their monthly income on housing than they had paid as a renter.

What is the government's role in the Sadowski Trust Funds?

To ensure accountability.

The Florida Housing Finance Corporation is charged with overseeing the implementation of the trust funds. Every local government receiving trust fund monies (all 67 counties and entitlement cities) must provide an annual report to the state that accounts for all housing trust fund monies. This report ensures that all funds are used in accordance with statutory guidelines. Having a state agency in charge of oversight was also a priority for the private sector industry groups.

Where can I find more research on the needs of affordable housing nationally and by state?

There are several national housing organizations that research the need for more affordable housing.

- The National Low Income Housing Coalition publishes Out of Reach each year

- The National Housing Conference publishes Paycheck to Paycheck annually

- The U.S. Department of HUD also maintains data sets on housing affordability and cost burdened households by state and county.

- Enterprise Community Partners, Inc. developed the Make Room Campaign to explain the struggle Americans are facing as renters.

- The Technical Assistance Collaborative produces the Priced Out Report which studies the severe housing affordability problems experienced by people with disabilities.

- The National Low Income Housing Coalition produces the Out of Reach Report highlighting the struggles of low income renters in America.

Where can I find more research on the needs of affordable housing in Florida and local communities?

Florida is fortunate to have a variety of research resources to evaluate the need of affordable housing in the state and local communities:

- The Florida Housing Coalition publishes the Home Matters Report annually

- The University of Florida has the Shimberg Center for Housing Studies

- The United Way of Florida produces the ALICE Report: Out of Reach Report

- The U.S. Department of HUD also maintains data sets on housing affordability and cost burdened households by state and county.